Public Accounting Track

The public accounting track will prepare students for a career in the public accounting profession, including passing the Certified Public Accounting (CPA) exam.

The CPA exam has recently been revised around a set of core skill sets (accounting, audit, tax, technology) and three disciplines requiring more advanced knowledge (core-plus-discipline model)

The public accounting track offers classes aligned with each of the three disciplines of the CPA exam (Tax Strategy, Business Reporting and Analysis, and Information Technology). The fourth focus area, Enterprise Risk Management, will help prepare students for the Business Reporting and Analysis discipline, as well as careers in advisory or consulting.

Core Courses (22 hours)

ACC 508 – Advanced Commercial Law

Currently taught by: Ernest Carraway

3 credit hours

Semesters offered: Spring

The principles of statutory law and common law relevant to corporate and public accountants. Legal research.

ACC 510 – Advanced Financial Accounting

Currently taught by: Robert Whited

3 credit hours

Semesters Offered: Spring/Summer 1

This course provides a thorough study of accounting for equity method investments, business combinations, and preparation of consolidated financial statements for a parent corporation and one or more subsidiaries. The course examines several international accounting topics including accounting for foreign currency transactions, accounting for hedges (risk transfer) of exposed foreign currency positions, conversion of foreign currency financial statements to US $ statements, and the movement towards harmonization of accounting standards worldwide. We will also thoroughly explore the use of and required accounting for various derivative securities.

ACC 519 – Applied Financial Management

Currently taught by:

Bonnie Hancock

3 credit hours

Semesters offered: Fall/Summer 2

A study of key business decisions made and tools used by chief financial officers (CFO) in their executive management roles. Students will focus on managerial analysis tools (e.g.,business plans, budgeting) and finance issues (e.g. funding alternatives, treasury, and cash management). The course will include management skills related to the CFO, such as negotiations, leadership, delegation, interactions with boards, etc.

ACC 530 – Advanced Income Tax

Currently taught by: Nathan Goldman

3 credit hours

Semesters offered: Fall

Federal income tax treatment of corporations, partnerships, estates, trusts, and profit and loss distributions to shareholders, partners and beneficiaries. Introduction to wealth transfer taxes and family tax planning.

ACC 533 – Accounting & Tax Research

Currently taught by: Kathy Krawczyk/Scott Showalter

Semesters offered: Fall

Research techniques applicable to tax laws, accounting standards, with emphasis on developing issues and facts, assessing authority, analytical skills, professional judgment, and formal communication of findings; use and application of traditional and computerized research databases; future of accounting discipline; ethics.

ACC 540 – IT Risks & Controls

Currently taught by: Tom Dow & James Scalise

3 credit hours

Semesters offered: Fall

Recognition of information technology risks. General and application internal controls for information systems environments. Client/server, end-user computing, and service bureau internal control environments. Computerized auditing techniques. Risks of emerging technologies.

ACC 550 – Advanced Auditing

Currently taught by: Scott Showalter

3 credit hours

Semesters Offered: Spring / Summer 2

Current issues and regulation of the auditing profession; application of generally accepted auditing standards and determination of sufficient competent evidential matter including analytical procedures and statistical sampling. Auditor ethics, other auditing services, government auditing, compilation, review, and other attestation services.

ACC 600 – Managerial & Career Effectiveness

Currently taught by: Jenkins MAC Staff

1 credit hour

Semester offered: Fall

Knowledge and skills needed to advance professional accounting career. Strategic communication of self and ideas in professional and classroom settings. Diagnosis of organizational culture. Impression management and appropriate business behavior. Leadership of individuals, group dynamics and team building.

Electives (9 hours)

Students in the public accounting track are not required to choose a specialization, however the MAC program offers three optional specializations. Each specialization requires nine hours of elective classes in the ERM, IT, or Tax Strategy areas.

If students do not choose an elective, nine hours of courses can be taken from any concentration area or they have the option of courses in personal financial planning, advanced corporate finance, investment theory and practice and sustainability and business. Courses are also available through NC State University’s Department of Public Administration.

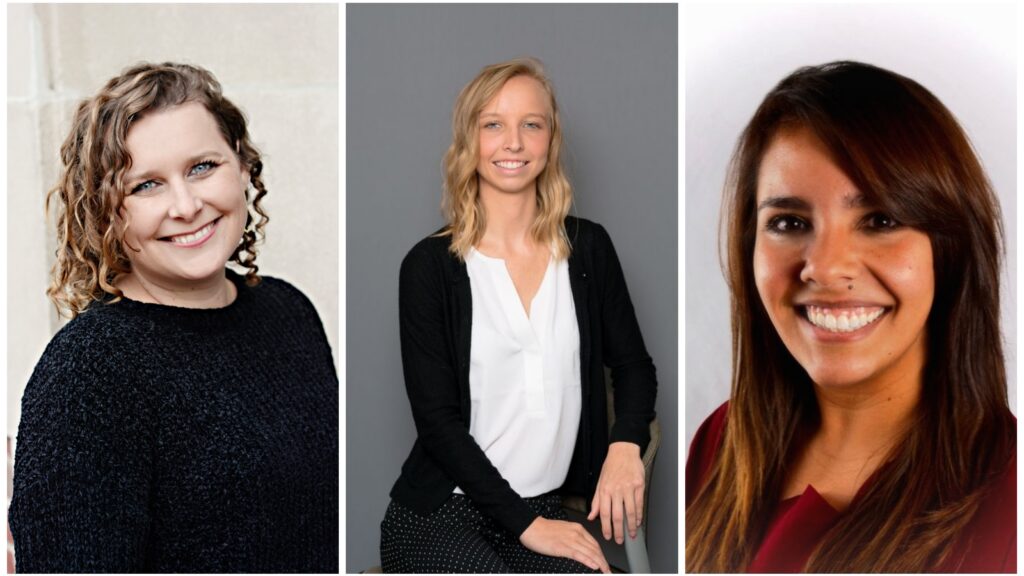

Three Alums Find Fulfillment in Public Accounting